помогитеее!! пожалуйста!! ааааа

Приложения:

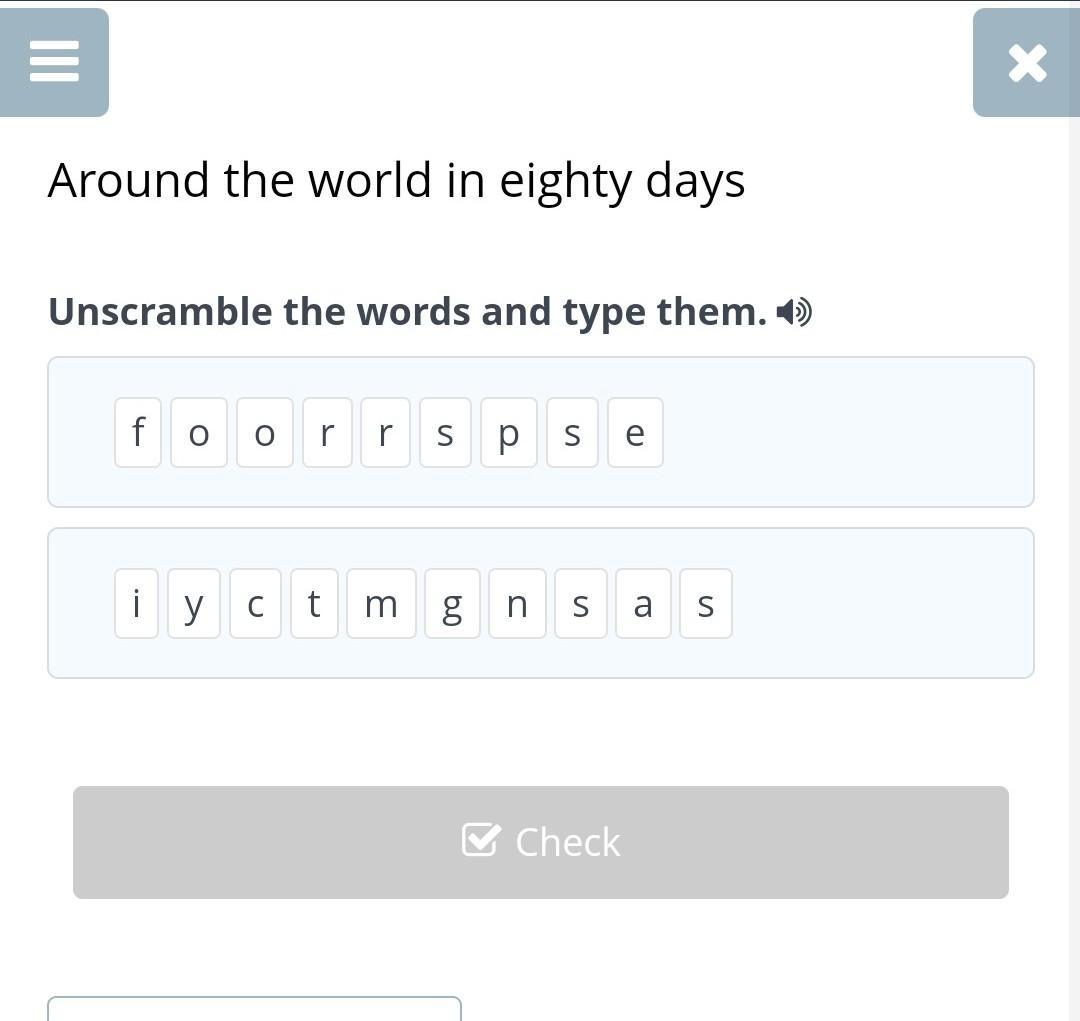

Ответы

Ответ:

p

r

o

f

e

s

s

o

r

g

y

m

n

a

s

t

i

c

s

Объяснение:

Похожие вопросы

Перевод текста, ПОЖАЛУЙСТА

My everyday activities are quite routine. They do not differ much from those of any other student of our country. On week-days I usually get up at 7 o'clock. I make my bed, open the window and do my morning exercises. Then I go to the bathroom where I clean my teeth and wash myself. If I have enough time I take a cold and hot shower. After bathroom I go back to my room where I dress myself and brush my hair. Now I am ready for breakfast I put on my coat, take the bag and go to the University. I live not far from the University, so it takes me only five or seven minutes to get there. I don't want to be late for the first pair of lessons so I come here a few minutes before the bell. I leave my coat in the cloakroom and go upstairs to the classroom.My lesson begin at 8.00 a.m. and they are over at 2.30. p.m. After classes I go home and have dinner there. I usually have something substantial for dinner, for example, cabbage soup for the first course, hot meat or fish with some vegetables for the second one. Then I drink a cup of tea or milk. Something when I have to stay at the University after classes I go to the students’ canteen and have dinner there. After dinner I have a short rest, read newspapers, make some telephone calls, go to the bakery. Then I do my homework. We study many subjects at the University and it takes me 3 or even more hours to prepare my homework. Something I go to the library to get ready for my practical classes or to write a report. As a rule I have no three time on my week-days.

Eight o’clock is supper time in our family. We all get together in the kitchen, then go to the sitting room and watch TV, read books or discuss different problems. Twice a week I go to the gymnasium in the evening to play volleyball, I am a member of the University volleyball team and we have our training rather late. At about eleven at night I go to bed.

Помогите пожалуйста перевести текст!

The goldsmith bankers were an early example of a financial intermediary.

A financial intermediary is an institution that specializes in bringing lenders and borrowers together.

A commercial bank borrows money from the public, crediting them with a deposit. The deposit is a liability of the bank. It is money owed to depositors. In turn the bank lends money to firms, households or governments wishing to borrow.

Banks are not the only financial intermediaries. Insurance companies, pension funds, and building societies also take in money in order to relend it. The crucial feature of banks is that some of their liabilities are used as a means of payment, and are therefore part of the money stock.

Commercial banks are financial intermediaries with a government licence to make loans and issue deposits, including deposits against, which cheques can be written.

Let's start by looking at the present-day UK banking system. Although the details vary from country to country, the general principle is much the same everywhere.

In the UK, the commercial banking system comprises about 600 registered banks, the National Girobank operating through post offices, and a dozen trustee saving banks. Much the most important single group is the London clearing banks. The clearing banks are so named because they have a central clearing house for handling payments by cheque.

A clearing system is a set of arrangements in which debts between banks are settled by adding up all the transactions in a given period and paying only the net amounts needed to balance inter-bank accounts.

Suppose you bank with Barclays but visit a supermarket that banks with

Lloyds. To pay for your shopping you write a cheque against your deposit at

Barclays. The supermarket pays this cheque into its account at Lloyds. In turn, Lloyds presents the cheque to Barclays, which will credit Lloyds' account at Barclays and debit your account at Barclays by an equivalent amount. Because you purchased goods from a supermarket using a different bank, a transfer of funds between the two banks is required. Crediting or debiting one bank's account at another bank is the simplest way to achieve this.

However on the same day someone else is probably writing a cheque on a

Lloyds' deposit account to pay for some stereo equipment from a shop banking with Barclays. The stereo shop pays the cheque into its Barclays' account, increasing its deposit. Barclays then pays the cheque into its account at Lloyds where this person's account is simultaneously debited.

Now the transfer flows from Lloyds to Barclays.

Although in both cases the cheque writer's account is debited and the cheque recipient's account is credited, it does not make sense for the two banks to make two separate inter-bank transactions between themselves. The clearing system calculates the net flows between the member clearing banks and these are the settlements that they make between themselves. Thus the system of clearing cheques represents another way society reduces the costs of making transactions.