Предмет: Математика,

автор: parhomnasta71

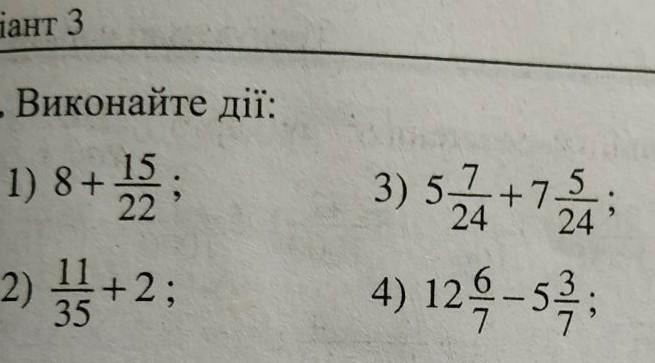

помогите решить,забыла.

Приложения:

Ответы

Автор ответа:

0

Ответ:

1) 8 15/22

2) 2 11/35

3) 12 12/24 или сокращенно 12 1/2

4) 7 3/7

Пошаговое объяснение:

Автор ответа:

0

Ответ:

1) 8 15/22

2) 2 11/35

3/12 12/24

4) 7 3/7

Похожие вопросы

Предмет: Русский язык,

автор: вика17112004

Предмет: Английский язык,

автор: Sanjar2003s

Предмет: Русский язык,

автор: kristina260

Предмет: История,

автор: lagutin2608

Предмет: Литература,

автор: Няша200411