Предмет: Математика,

автор: kirillborodin126vv

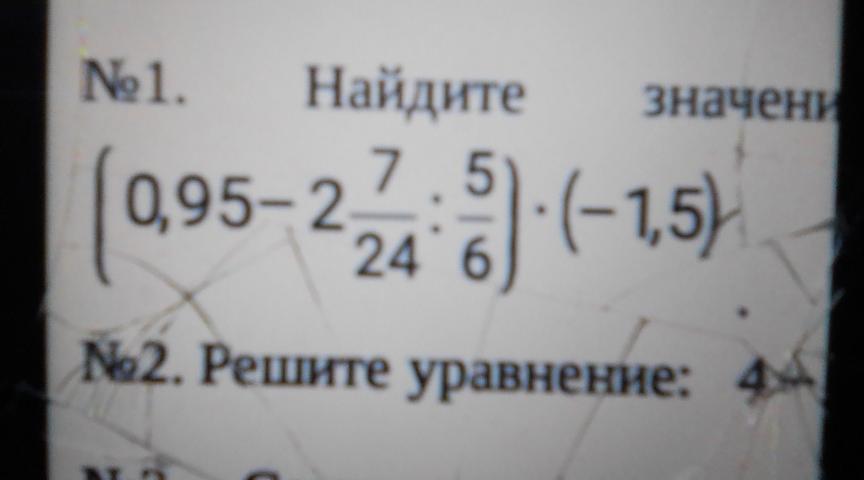

Помогите пожалуйста решить задачу,очень срочно!!!!!

Приложения:

Ответы

Автор ответа:

1

Ответ:

Пошаговое объяснение:

2 7/24:5/6=55/24*6/5=11/4=2,75

0,95-2,75=-1,8

-1,8*(-1,5)=2,7

Похожие вопросы

Предмет: Английский язык,

автор: marysqqa

Предмет: Русский язык,

автор: Matsuro09

Предмет: Английский язык,

автор: Yenata96

Предмет: Математика,

автор: ааа403